New Member Checklist: Setting up banking and tax information

First, log in to the Member Hub and click View Member. Locate the 'Member Settings' section of the left-side menu and click Banking Information.

Adding your Banking & Tax Information in the Member Hub

On each step, fill out and verify your information, then click Next to move to the next step. Complete each step until you see a final confirmation message on Step 4.

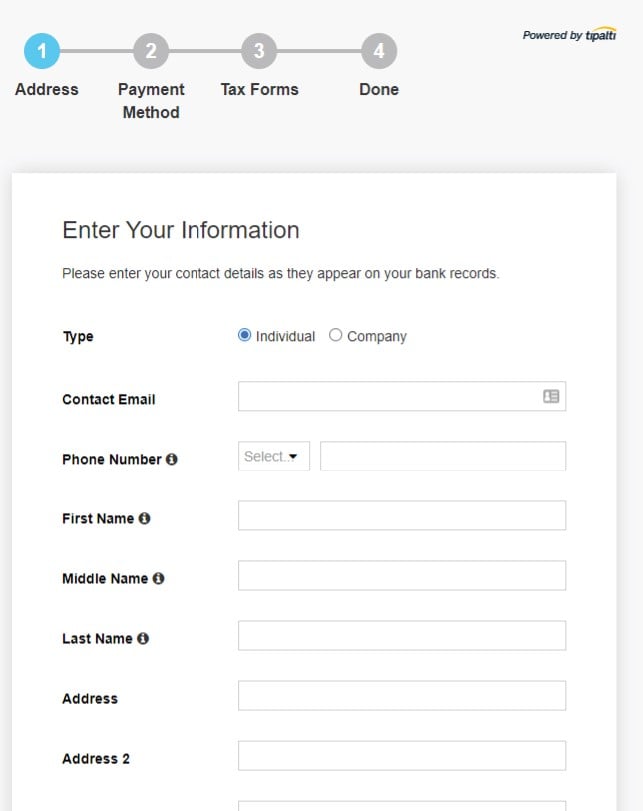

STEP 1 | ADDRESS

- In the “Type” field, you can toggle between Individual or Company.

- Select Individual if you will be paid under a Social Security Number (SSN).

- Select Company if you will be paid under an Employer Identification Number (EIN).

NOTE: The name and email fields must match those same fields on Step 3 (Tax Forms).

This will need to be the address you use for tax reporting purposes. You may get a pop-up asking to confirm your address if our system cannot verify it.

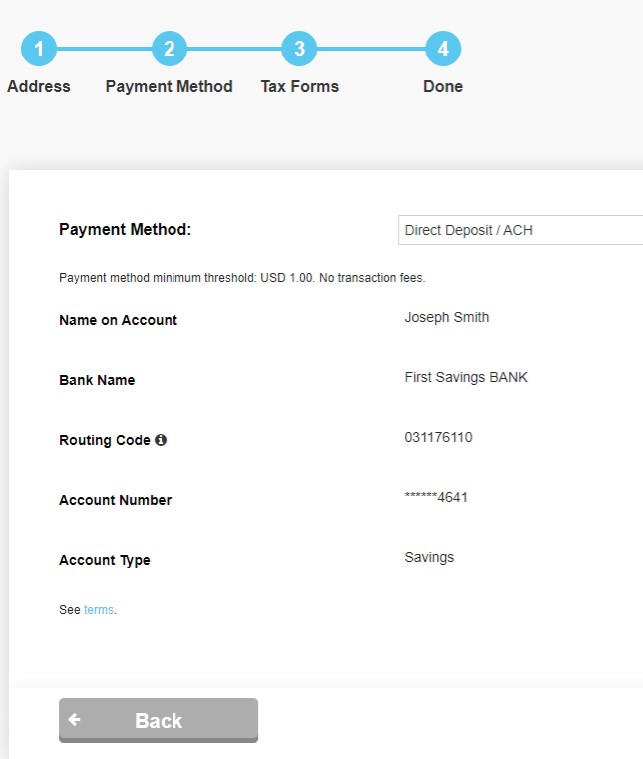

STEP 2 | PAYMENT METHOD

- If you are signed up as “Individual,” the name field will be pre-populated and cannot be changed.

- If you are signed up as “Company,” the name field will be pre-populated, and you will be given the option to continue with the personal name or the company name you entered in Step 1.

- The currency changes based on the address provided on Step 1 (Address). However, if you choose check as your payment method, it will be sent in United States dollar (USD).

TIP: If you are trying to collect under your company name and it is not populating correctly on Step 2 (Payment Method), please ensure you have selected the correct “Type” on Step 1 (Address) Company vs. Individual.

Payment choice:

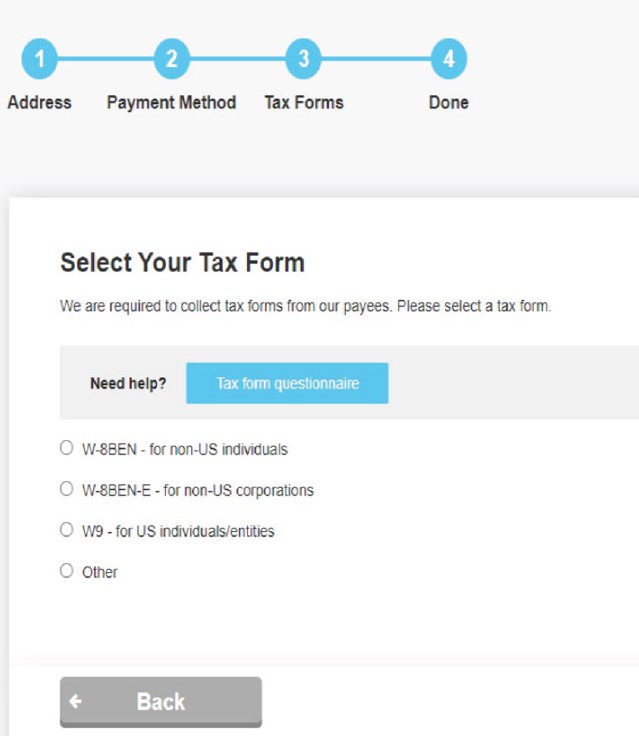

STEP 3 | TAX FORM

- Make sure to review your records with the IRS and double-check that the name you enter on your tax form matches the name on file with the IRS exactly (including punctuation and abbreviations).

- Everything is required except “Business Name/Disregarded Entity Name."

- If filing as a Company, make sure to list your business name in field 1 (“Name”).

NOTE: Members will be unable to update their banking and tax information each month from the 3rd-14th.

This is to ensure the royalties for each month’s distribution will be routed to the correct account.

What's the difference between tax forms?

| W-9 | An entity or individual that is a resident in the US for tax purposes. |

| W-8BEN | An individual who is not a tax resident in the US and is the beneficial owner of income. Not relevant for entities. |

| W-8BEN-E | An entity that is not a resident within the US for tax purposes and is the beneficial owner of income. |

- Please consult a tax professional if you are unsure which form to fill out.

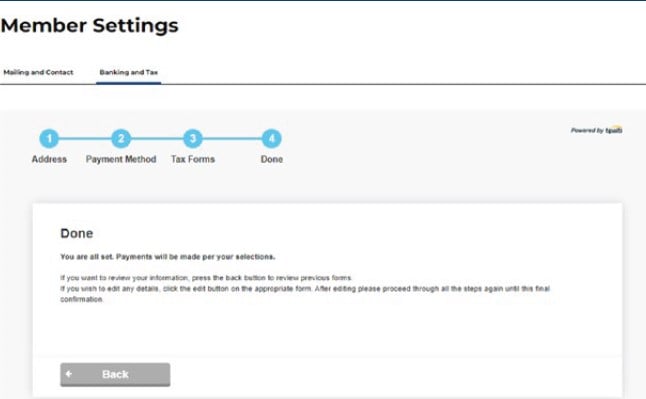

STEP 4 | DONE

You've successfully setup your banking and tax information!